When Adelaide Designer Homes was placed into liquidation last month electrician Ralph Czabayski was one of more than 80 creditors left out of pocket.

It also left 20 home owners like Joanna and Henry Clough without a completed home.

They’re now living in their friend’s tiny spare room and are expecting a baby next month.

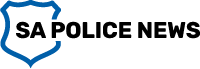

Mr Czabayski is $80,000 out of pocket. It’s a staggering figure but for him it’s just the cost of doing business.

Ralph Czabayski is one of the creditors owed money by Adelaide Designer Homes. (ABC News: Carl Saville)

His family has owned Star Electrical for more than 40 years and he told 7.30 Adelaide Designer Homes is the seventh builder who’s owed him money to have collapsed over the past 15 years.

“No-one likes to lose money, without a doubt, because … I paid the wages for our electricians, materials for all of those jobs. So yeah, of course I would have loved to be paid,” he said.

“Luckily we’re busy and we can work our way through it but, look, it definitely hurts.”

The Cloughs, though, have been left with a house frame. No wiring, no plumbing, no gyprock.

Inside Joanna and Henry Clough’s incomplete home. (ABC News: Carl Saville)

They signed with Adelaide Designer Homes in December 2020. Their build at Mt Barker in the Adelaide Hills was plagued by delays from the start.

“It wasn’t until January 2023 until the slab went down,” Mr Clough told 7.30.

“Once the slab went down … we thought this is the year, thinking it would be under 12 months that it would be built.

“My gut was telling me the big red flags were obviously popping up.”

The Cloughs are trying to find a new builder to complete their house. (ABC News: Carl Saville)

“I’ve got a best mate who’s an electrician in the building game, my uncle’s in the building industry. I knew a lot of people in the construction industry and they were all saying, ‘What’s going on?’

But the delays continued and communication dropped off. Mr Clough said Adelaide Designer Homes then confessed to having financial problems and it had to sell its head office to boost cash. It wasn’t enough to survive.

He would later get a phone call from administrators Clifton Hall, saying Adelaide Designer Homes had gone into liquidation.

The Cloughs thought they’d be living in their new home by now. (ABC News: Carl Saville)

“It honestly … felt like a weight was lifted off our shoulders,” Mr Clough told 7.30.

Insolvencies at historic high

Adelaide Designer Homes is one of 601 companies in the construction sector to have become insolvent since July.

More than 600 construction companies have become insolvent in the past two and a half months. ( ABC News: Peter Drought )

Last financial year a staggering 2,977 companies in the construction sector became insolvent.

John Winter from the Australian Restructuring Insolvency and Turnaround Association says the Morrison government’s HomeBuilder grant during the COVID-19 pandemic led to a massive housing boom, and fixed-price contracts had brought firms on tight margins unstuck.

Adelaide Designer Homes was among those to succumb to rising costs.

John Winter expects the high rate of insolvencies to continue for the next couple of years. (ABC News: Shaun Kingma)

“Insolvencies in the construction sector are at historic highs and it’s caused by a number of factors coming together all at once,” Mr Winter told 7.30.

“There’s no doubt that material costs have been one of the most significant impacts on home builders.

“What’s been happening is that erosion of their profit margin has been so large that they’ve ended up running each of their jobs at a loss.

“There’s only so long you can sustain that for before you end up being insolvent, and that’s what’s been characterising the market of late.”

Last month, Reserve Bank of Australia governor Michele Bullock warned rising material costs and trade shortages in the construction sector were making it difficult to get inflation back to target.

RBA governor Michele Bullock said the high price of building materials was making it hard to get inflation under control. (AAP: Dean Lewins)

Mr Winter expected more insolvencies to come.

“I don’t think we’ve seen the full impact of inflation and rising interest rate costs in terms of what that’s going to do to the entire sector,” he said.

“I think we’re going to see continually high insolvencies within construction for at least the next 18 months to two years.”

Challenges on site

Mr Czabayski said he was feeling the pain of rising costs.

“All our materials have just skyrocketed,” he said.

“Cable, in regards to copper, was probably the worst, which went up by about 70 per cent and that was over increments.

“Power point switches, clips, everything that goes in the job also went up by at least 50 per cent and unfortunately nothing’s come down.”

The home-building industry crisis has come at the worst possible time given housing demand.

Public infrastructure projects have been blamed for taking tradies away from the housing sector. (ABC News: Victoria Pengilley)

The federal government has set a target of building 1.2 million new homes over the next five years.

Analysts predict the government will fall short of the target by 260,000 homes.

Minister for Housing Clare O’Neil told 7.30 the target was an aspirational one but could not guarantee the government would achieve its goal.

“What I can tell you is it is bold, it is ambitious, and that is exactly the kind of thinking we need if we’re going to get any traction here,” Ms O’Neil said.

“If we’re all sitting around saying it’s too hard to address this crisis, we’re going to be in a crisis forever.”

The New South Wales productivity commission said public infrastructure projects were taking much-needed tradies from the housing sector.

Mr Czabayski said it was a similar situation in South Australia.

“We’ve got some great electricians and apprentices working at Star Electrical, but keeping them, it’s a hard job,” he said.

“Unfortunately a lot of the A-class electricians are always asking for more and more money … and they go off to another job that’s obviously offering more money.”

Ms O’Neil acknowleged the issue and said the government is working on solutions to address labour shortages and continuing to invest in training.

The long hunt for a builder

Thankfully for the Cloughs, Adelaide Designer Homes was required to carry insurance.

The Cloughs hope their home will be finished by Easter. (ABC News: Carl Saville)

But if there is a shortfall between the payout and the cost of finishing their home, the couple will have to dip into their own pockets.

She said bigger builders weren’t interested in completing a half-finished house.

“I’m under the impression it’s because they’ve got so much work, they don’t need to take on something like this, something that’s hectic, something that’s full-on,” Ms Clough told 7.30.

“Even though we started the process of contacting new builders the second week of August, we’ve only just got our first quote back.”

Mr Clough said he’d like to see more transparency from builders to protect customers.

From the outside, the Cloughs’ home almost looks finished but it’s a very different story inside. (ABC News: Carl Saville)

“You know, how many contracts have they got? How delayed are they? Are they on time? All those sort of things that can lead you to understanding the position they’re in,” he said.

The couple hope they’ll soon confirm their new builder and that their dream home might be finished by Easter 2025.

“Obviously, we’re not going to have a house before the baby comes, but I think it’s just important to, you know, relish in the fact that we’ve got a little one coming along [and] not to stress too much about the house,” Mr Clough said.

Watch 7.30, Mondays to Thursdays at 7:30pm on ABC iview and ABC TV.