Rapidly growing house prices and sluggish wage growth means many young people have given up on the idea of ever becoming home owners.

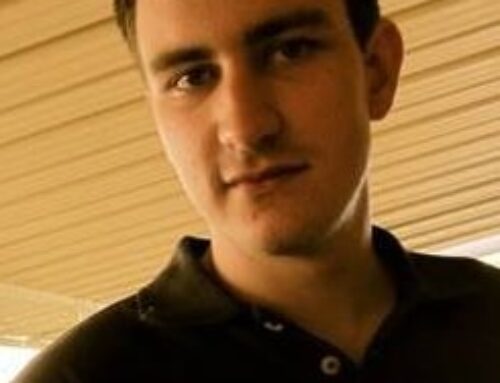

Erin, 25, and Jack, 27, say once they pay rent and other expenses there’s no money left over to save for a house deposit.

The working couple see their future as forever renters.

“[It’s] incredibly bleak … there is a huge issue in general across Australia where housing is seen as an asset, not a human right,” Erin said.

The couple managed to find an affordable rental in the historic suburb of Battery Point in Hobart.

“It’s just like a really nice place to live, everybody is super friendly and … welcoming and really inclusive which is cool,” Erin said.

But buying a home in the affluent suburb would be out of the question for the couple.

According to property data and analytics company CoreLogic, Hobart’s median dwelling price is $646,863, while across Australia the median dwelling price is $798,207.

“We’ve got no hope really of being able to afford a place of our own,” Erin said.

It was a different story for their parents’ generation.

According to the Grattan Institute, until the late 1990s house prices broadly tracked income growth. But between 1992 and 2018 house prices grew at almost three times the pace.

“The wealth gap between generations in Australia is an increasing problem,” the institute’s Joey Moloney said.

Home ownership rates in young people have fallen for young Australians.

In 1981, 68 per cent of 30-34 year olds owned their own home. In 2021, that figure was 49 per cent.

“We’ve got fewer homes that are worth more that are concentrated in older, wealthier hands, so it’s very easy to see how it’s increasing wealth inequity,” Mr Moloney said.

Life-long renters in a system designed for the short term

The flip side of falling home ownership rates is that younger Australians are renting for longer, and more will be renting forever.

But Australia’s renting system is not designed for lifelong renting, according to Michael Fotheringham from the Australian Housing and Urban Research Institute.

“It was a system that was designed with the intention of renting as a transitional tenure between living with parents and buying your own place,” Mr Fotheringham said.

Australia’s rental system is different from some European countries where lifelong renting is more common and there’s more institutional investment in housing.

“In Australia, 70 per cent of rental properties are owned by somebody who owns just one investment property, 90 per cent by someone who owns just one or two, so it’s a very fragmented market,” Mr Fotheringham said.

In addition rentals are regulated at a state and territory level, which means different rules around the country on things like no cause evictions and caps on rent rises.

“We need to look at those international models, what is good practice, how do we attract good investment into the rental market that’s not about short-term capital gain,” Mr Fotheringham said.

With more young couples raising children in rentals, there are calls for a greater focus on security and quality of tenure.

“Being forced to move when you’ve got kids in daycare and a commute to your job, that’s another thing all together,” Joey Moloney said.

While happy in her current rental, Erin said in a tight market, renters are often too scared to ask landlords for improvements for fear of eviction.

“Renters are almost seen as second-class citizens,” she said.

“I’ve had experiences myself [in previous rentals] of black mould, people getting electrocuted in houses, people living in electrically unsafe houses, no proper heating and cooling.”

Jack would like to see rewards for landlords who provide long-term tenure, rather than the current system of negative gearing which provides tax breaks for investment property owners who operate at a loss.

“If you had incentives for having a tenant for five years or 10 years that’s great because [the tenant] can make a bit of a life plan.

“But at the moment that doesn’t exist so you can’t plan ahead,” he said.

National Cabinet is working on a better deal for renters, which will include a national policy requiring reasonable grounds for eviction and rules around rent rises.

Climate change, HECS debt, and no kids – a generation facing a different future

Erin is emotional when asked about her future.

“I want to say it’s going to get better, I want say I have a really bright future ahead of me, but I don’t think so.”

It’s not just the cost of housing on her mind.

She said her Higher Education Contribution Scheme (HECS) debt seemed unsurmountable, despite her earning a “pretty good wage” and with federal government changes to lower indexation.

“Even then the amount I am paying off per year is … absolutely minimal.”

Her concerns about the future of the planet mean she has decided not to have children.

“Climate change is probably the biggest thing on my mind when I think about what I am going to have deal with in the next 10 years, and I don’t see it going very well,” she said.

Jack said he was also concerned about climate change.

“With the climate crisis I would not want to bring up kids in this world so that’s one aspect, but I guess the other aspect is even if I did want kids it’s just affordability,” he said.

Without home ownership, younger Australians will face tough times in retirement

Falling home ownership rates means the retirees of the future are more likely to be renters.

It is predicted home ownership rates for people aged over 65 will have fallen from around 80 per cent today to 65 per cent by 2056.

“If you’re not a home owner, you’ve got to pay rent in retirement, which means your living expenses are much more expensive than someone who has paid off their mortgage,” Joey Moloney said.

He said the federal government would need to consider lifting rental assistance to ensure renters in retirement have an adequate standard of living.

Roger Wilkins, a professorial fellow with the Melbourne Institute of Applied Economic and Social Research has run a household survey of 17,000 Australians since 2001.

He said young people, particularly those in their 20s, were not faring as well economically as older generations, and it was hard to see how that would play out when those younger Australians retire.

“This age group will retire with considerably more superannuation than some generations before them, but that doesn’t necessarily translate to a comfortable retirement,” Dr Wilkins said.

He said if home ownership did not happen until a person was in their 40s or 50s then they will still have a considerable house debt by the time they retired.

“Do they use their superannuation to pay off the home? In which case superannuation is not really serving its purpose because it’s meant to fund retirement.

“It does raise the prospect of more people in the future being reliant on the age pension,” he said.

Do young people have any reason to be optimistic?

The Australian government has announced plans to build 1.2 million homes in the next five years across the country.

“I’m optimistic we have turned a little bit of a corner,” Mr Moloney said.

“If we do the right reforms to make it easier to build those homes, that will make housing cheaper and that’ll make it more accessible for younger Australians.”

The intergenerational wealth divide could play out in the upcoming and future federal elections.

“It’s electorally not inevitable that the votes will continue to fall in favour of home owners,” Dr Wilkins said.

“It’s certainly a thorny issue for government, they’re trying to improve housing affordability while not upsetting existing home owners by devaluing their properties which is a very difficult needle to thread,” he said.

Erin is not confident those in power will address the issue of generational inequality.

“I feel really grim about it

“I just don’t think while we have people in politics who own their own investment home like the majority of politicians … [that] anything is going to change, because there is no incentive to do that.”